A Comprehensive Guide to US Financial Life Insurance

In today’s uncertain world, securing a financial safety net for loved ones is essential. One of the most effective ways to achieve this is through life insurance. Life insurance can provide your family with financial stability when they need it the most. This guide will walk you through everything you need to know about US financial life insurance, from types and benefits to key considerations and frequently asked questions.

What is US Financial Life Insurance?

Life insurance is a financial product designed to provide a payout to beneficiaries upon the policyholder’s death. US financial life insurance, specifically, refers to various types of life insurance policies available within the United States, catering to diverse needs, age groups, and financial situations. The primary goal of life insurance is to ensure that your family has financial support when you’re no longer there to provide it.

Types of Life Insurance Policies in the US

Understanding the different types of life insurance policies can help you choose the one that best aligns with your financial goals and family needs.

1. Term Life Insurance

Term life insurance is one of the simplest and most affordable types of life insurance. This policy provides coverage for a specified term, usually between 10 and 30 years. If the policyholder passes away within the term, beneficiaries receive the death benefit. However, if the term expires while the policyholder is still alive, no payout is made.

Key Benefits of Term Life Insurance

- Affordability: Premiums are generally lower than other types of life insurance.

- Simplicity: Straightforward terms and conditions make it easy to understand.

- Flexibility: Term lengths can be customized according to your family’s needs.

2. Whole Life Insurance

Whole life insurance offers coverage for the policyholder’s entire life, as long as premiums are paid. In addition to the death benefit, whole life insurance has a cash value component that grows over time and can be borrowed against.

Key Benefits of Whole Life Insurance

- Lifelong Coverage: Coverage lasts a lifetime, providing peace of mind.

- Cash Value Accumulation: Builds cash value over time, which can serve as a financial asset.

- Guaranteed Premiums: Premiums generally remain the same throughout the policy.

3. Universal Life Insurance

Universal life insurance is a flexible policy that combines life coverage with investment opportunities. Policyholders can adjust their premiums and death benefits over time, offering a level of control that is not available with other policy types.

Key Benefits of Universal Life Insurance

- Flexibility: Adjustable premiums and death benefits based on your financial situation.

- Cash Value Growth: Potential to grow cash value depending on investment performance.

- Investment Opportunity: The ability to invest a portion of your premium.

4. Variable Life Insurance

Variable life insurance allows policyholders to invest the policy’s cash value in various investment options such as stocks and bonds. While this can result in higher returns, it also involves greater risk.

Key Benefits of Variable Life Insurance

- Higher Growth Potential: Opportunity to increase cash value through investments.

- Investment Control: Policyholders have control over investment choices.

- Flexible Death Benefit: Death benefits can fluctuate depending on investment performance.

Why is Life Insurance Important?

Life insurance is a vital component of a comprehensive financial plan. It ensures that your family remains financially stable even in your absence. Here are some of the key reasons why life insurance is crucial:

1. Financial Security for Loved Ones

Life insurance provides financial support to your family during a challenging time, covering expenses such as mortgage payments, college tuition, and daily living costs.

2. Debt and Liability Coverage

The death benefit can be used to pay off debts, ensuring that your family won’t inherit financial liabilities.

3. Wealth Transfer

Life insurance can serve as a tax-efficient way to transfer wealth to your beneficiaries, ensuring they receive the intended financial support.

4. Supplementary Retirement Income

Permanent life insurance policies, like whole or universal life, build cash value over time, which can serve as a source of retirement income or emergency fund.

How to Choose the Right Life Insurance Policy

Selecting the right life insurance policy depends on various factors. Here’s a step-by-step guide to making an informed decision:

1. Assess Your Financial Needs

Determine the amount of financial support your family would need to maintain their standard of living, including major expenses like mortgages, education, and healthcare.

2. Consider Your Budget

Choose a policy that aligns with your budget. Term life insurance is often more affordable, while whole and universal life policies offer cash value accumulation but come at a higher premium.

3. Compare Policy Types

Consider your long-term financial goals. If you need temporary coverage, a term life policy may be ideal. For lifelong coverage with savings potential, whole life or universal life may be more suitable.

4. Evaluate Insurance Providers

Research insurance providers to ensure they have a solid reputation, strong customer service, and favorable policy options. Financial stability is essential, as you’ll want a provider who can fulfill its obligations when the time comes.

5. Consult a Financial Advisor

Life insurance can be complex, and consulting a financial advisor can help you understand which policy fits best with your financial plan.

Key Takeaways

- Pacific Life is the best life insurance company of 2024, based on our analysis.

- The best life insurance companies offer a range of policies, including term and permanent coverage.

- Several companies in our rating offer life insurance policies without a medical exam.

Our Best Life Insurance Companies Rating

Frequently Asked Questions About Life Insurance

1. What is the difference between term and whole life insurance?

Term life insurance provides coverage for a set period, while whole life insurance covers the policyholder for life. Term policies are generally more affordable, but whole life policies build cash value over time.

2. Can I change my life insurance policy later?

Many policies allow you to make adjustments. For example, with universal life insurance, you can change your premiums and death benefit. Some term policies also allow you to convert to permanent insurance before the term expires.

3. How is the death benefit paid out?

The death benefit is typically paid as a lump sum to the beneficiaries, although some policies offer installment options.

4. Do life insurance policies have tax benefits?

Yes, the death benefit is generally tax-free, and some policies offer tax-deferred cash value growth.

5. Is medical underwriting required?

Most life insurance policies require a medical exam, although some simplified issue or guaranteed issue policies are available for those who prefer not to undergo medical underwriting.

Conclusion

US financial life insurance is a powerful tool to protect your family’s future. Choosing the right policy ensures that your loved ones are financially secure in the event of your passing. Whether you opt for term, whole, universal, or variable life insurance, it’s essential to understand your financial goals and family needs. Taking time to explore your options and consult professionals can lead to a policy that provides peace of mind and lasting security for your family.

FAQs

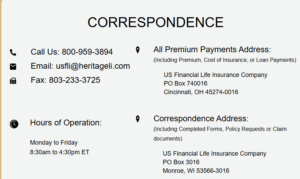

Policy Inquiries

>Premium or COI Payments

>How do I pay my life insurance premiums or Cost of Insurance (COI)?

>Where do I mail payments for my policy?

>Can I change my premium payment billing mode?

>How do I change the bank account for my electronic payments or set up electronic payments?

>Do I need to include a voided check or bank letter with the Electronic Payment Authorization form or the >Authorization for Direct Deposit form?

>How do I update my premium payment to increase my Cost of Insurance payment?

Policy Changes

>How do I update my Address?

>How do I change the Beneficiary on my policy?

>How do I change the Owner of a policy?

>How to file a Claim

>How do I notify U.S. Financial Life Insurance Company of a recent death of an insured or owner?

>How do I cancel my life insurance policy(ies)?

>How do I stop my automatic bank drafts?

>Why did my Term Life Insurance premiums increase?

>What is Cost of Insurance (COI)?

>Will the billed premium or automatic bank draft increase with the Cost of Insurance(COI) increase?